The doomer case for the final death of crypto

I have been in a state of mild shock and disbelief ever since I woke up on Tuesday morning, rolled over in bed, opened Twitter on my phone, and saw the news of FTX’s insolvency. At that moment, in a deep and fundamental way, unlike with any of the insane crashes or blowups that had happened so far in 2022, I felt my outlook for crypto immediately shift in a pessimistic direction. I now believe that the probability that crypto enters a slow and irreversible decline from which it never recovers has dramatically increased.

I would like to lay out the case for this maximally pessimistic scenario and write down why I think that the collapse of FTX and Alameda Research make it far likelier than it was a week ago. I am not saying that I am necessarily wrong or right; in the end, predicting the future is nearly impossible, and if Bitcoin or Ethereum hit new all-time highs in the next decade, I am sure people will come and laugh at me. I will probably also be laughing at myself (while crying over the fact that I capitulated at the rock bottom). This post should be read as an exercise in reflection, an attempt to pick up the pieces and formulate one concrete picture of what the future might look like. Perhaps none of this will happen! Perhaps crypto will blossom into the foundations of a new financial system based on transparency and equal access! But even if you’re bullish, shouldn’t you try to think through the worst case scenarios?

Well, without further ado, everyone loves a bit of baseless prognostication, so…

The basic doomer thesis

Basically, I think that something like the following is going to play out over the next couple months.

On the institutional and “builder” side:

- “Blue-chip” institutions like Paradigm and Sequoia get burned so badly that VCs and LPs both have permanent PTSD about crypto

- Crypto protocol valuations, which are still arguably >10x as high as they should be, slowly regress back to or even below normal levels

- Existing protocols slowly run out of money and are forced to either fold or raise down rounds at much lower valuations

- New protocols are subject to much higher levels of continual scrutiny from all angles

- Overall enthusiasm for building on top of existing technology dwindles to a trickle, especially as organic user activity dries up, the space loses all remaining prestige, and developers lose hope in the long-term potential of crypto to do good for the world

- In total, almost all investor and developer activity disappear from the space

- (Extra!) Brutal regulatory crackdowns, spurred on tenfold by SBF’s attempt to co-opt Congress and the SEC, continue to target and crush the weakest protocols while slowly driving out any potential growth of decentralized finance in the developed West

On the retail side:

- Sentiment hits rock-bottom in a cross-sectional way that doesn’t just impact “dumb retail” but depresses the enthusiasm of its true believers and smartest users

- People start noticing, “whoa, it’s not just Fred the dog coin investor who’s giving up on crypto but Mark, the smartest guy in my group of friends who went to Caltech and was professionally successful for years beforehand,” and themselves lose confidence in crypto

- Distrust about centralized exchanges and general lack of enthusiasm for a trickle continue to mean net inflows into the system are negative

- Insofar as crypto satisfied the need of rich Westerners to gamble online, those desires are satisfied via easier and more reliable conduits such as equity options and sports betting

Much of this sounds, perhaps, like “generic bear market reasoning,” so to speak. However, I think that there are certain key points that people are ignoring or failing to properly appreciate. First, the shock and loss of credibility extends to the “highest levels.” With every single previous crypto market implosionーeverything from OHM to the depegging of USTーthe people perceived to be the smartest and most competent operators in the field were unaffected. Sure, when the price of LUNA went down to zero, a bunch of degenerate Koreans got rinsed, but basically everyone I personally knew was completely unaffected. Certainly nothing like Sequoia or Paradigm losing hundreds of millions of dollars happened.

Like it or not, these people bring both credibility and money to the space, whether we’re talking about a VC fund with a strong reputation in Silicon Valley or smart, quant-ish developers who see the technological potential of crypto and indirectly start to evangelize the long-term vision to their friends. This time, however, the losses extend far deeper than ever before. There has and always will be a “core group” of committed crypto diehards who never give up on the dream of decentralization, but never has that group suffered losses so severe as in the past week.

Sentiment is everything in crypto. Asset values, as well as user and developer interest, are notoriously reflexive. Just because there will be a nonzero number of people left does not mean that we will ever be able to amass enough momentum to grow back into something larger. I mean, Ethereum may very well keep producing blocks for the rest of my life, and Africans or Ecuadoreans or Venezuelans or people from literal failed states will always find some value in having access to crypto. It won’t literally disappear. But it can get pretty close to disappearing relative to where it stands now, and there may no longer be enough people with enough faith to keep the flame alive for much longer.

Second, I believe people are underestimating the severity of the inevitable regulatory crackdown. We are not talking here about the failure of a shady quasi-bank like Celsius which targeted American consumers or the collapse of an algostable made by a South Korean developer. Instead, we are talking about the total failure of the singular man in crypto, Sam Bankman-Fried, known for making enormous political donations, testifying before Congress, and actively seeking to work with regulators to shape policy.

Perhaps you are skeptical that Gensler’s SEC really prioritizes the “protection” of US citizens. Perhaps you are skeptical that Congress itself cares much for the American people. I could not fault you too much for harboring some doubts. However, what I am pretty sure about is that when you directly lie to these people, they are going to get pretty angry, and that anger may have some very severe consequences for crypto as a whole. We are not talking about attempt #1982301 to steal Americans’ money via a thinly disguised Ponzi scheme; instead, we are talking about a blatant attempt to pull the rug over the eyes of the people in charge of this nation. Authority does not typically take well to such provocations.

Frankly, if you pressed me on it, would I be able to say that Congress is wrong for wanting to regulate crypto? I think it would be quite challenging to make that assertion after fraud has been revealed at the highest levels and in the most unexpected quarters. Sure, theoretically, crypto has some good use cases and benefits some parts of the world, but on net, has it actually been anything but a huge money and productivity sink for American consumers? Not really. At this point, pleading that crypto might eventually become a net good just sounds inane, and in any case the institutional fallout is so severe that the window of opportunity for crypto to demonstrate real utility in the developed world before it gets regulated to death just got a lot narrower.

The developers, too, will slowly leave. Who wants to believe that they’re working for an industry that will never be net good for the world? “Why should I keep developing a protocol that nobody will use?” “This space is totally rotten. I feel like I’m shellshocked and can’t keep working anymore.” These are real statements that real builders have told me in the last two days. Sure, there may not be any sudden exodus where thousands of developers quit their jobs overnight, but gradually, one by one, most of them will eventually reach a point in their rationalizations where they can no longer justify continuing onward.

And there we have itーno dramatic explosion into smithereens, but instead the most depressing, irreversible grind toward zero conceivable, with no hope for recourse.

Counterpoint: “Crypto always comes back”

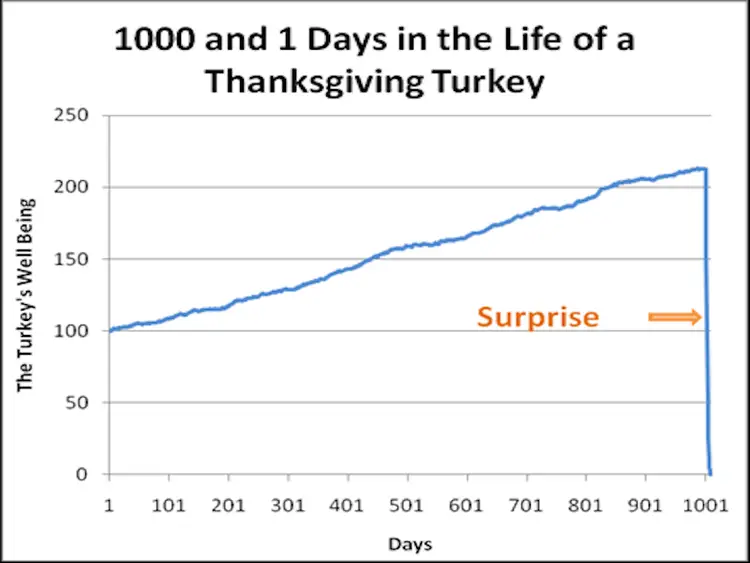

Saying “crypto always comes back” is like saying “the turkey always wakes up the next morning.”

Frankly, I think that when people tell you to “zoom out bro, have some conviction,” they are either:

- Engaging in a psychological coping mechanism where they avoid looking at the actual details of reality, instead preferring to lazily pattern-match to the past, or

- So rich that it doesn’t actually matter to them if prices go down another 90% or 95%.

If you cannot articulate a reason more definite than “have some conviction, bro,” you are admitting that you did not arrive at your conclusion via any process of actual logical reasoning, but are instead simply naively extrapolating from base rates and ignoring the incredible and massive differences between this collapse and the previous ones.

Sure, people who have said “it’s different this time”! have typically been wrong. But were you right about those times either? In 2018, did you predict that crypto would ascend into stratospheric heights fueled by an “everything bubble” as a result of low interest rates caused by a literal global pandemic? I suspect not.

Look, if someone comes up to you and tells you, “this time it truly is different,” and they give you a long list of good reasons why this time actually is different, and your response is to simply insist that it’s not, you have not actually engaged them in argument. Your position is one of pure faith, because if it wasn’t, there would be reasons that you could articulate beyond making broad, mystical assertions about the immutable value of crypto.

Counterpoint: “Builders will keep building”

For whom will the builders build? The ten people left trading back and forth on any given chain after the dust settles? What, exactly, will they buildーthe 51st decentralized perps protocol on Aptos?

I don’t mean to be too criticalーafter all, in the end I am myself a builder, so to speak. And it is indeed my intention to keep on building, insofar as there remains something to build on top of. So to some extent, yes, builders will keep on building!

But, my dear reader, surely you see what point I am getting at here? Saying that “builders will keep on building” is akin to saying “Ethereum will keep on producing blocks.” Sure, I have no doubt that there will be some builders who keep on building something on the blockchain. However, fundamentally, this only results in something good if they are building products that are used by and deliver value to actual people!

It does us little good if Ethereum keeps on producing blocks but the only thing occupying block space is CEX/DEX arbitrage, the occasional News Event Inu meme coin, and the increasingly infrequent movement of funds of the dwindling handful of people who haven’t just deposited into Coinbase or stuck everything in a hardware wallet, committing to not touching crypto again for the next several years.

There is a valuable core of an idea here, which is that the next generation of builders will invent the primitives which spark a new wave of crypto adoption, much like Vitalik and Hayden Adams did with Uniswap and the xy = k invariant AMM. I do not deny that this is theoretically conceivable. However, simply noting the theoretical possibility of this outcome does not mean that it is certain or even likely. It also ultimately does us little good to have beautiful protocols on chain that are effectively unusable because harsh securities regulations and KYC/AML requirements have crushed the ability of normal people to easily onramp or offramp funds!

Speaking of regulation, the fundamental ability to build also depends, in part, on the encroachment of the regulatory state and the willingness of institutions to engage with crypto. Yes, if you’re building a completely anonymous, fully decentralized, immutable protocol, then you don’t necessarily need either of these. However, if you want to have effects on the “world of atoms,” so to speak, you depend on the good graces of the government and big business. How do you propose to tokenize the S&P 500 or bring Treasuries on-chain without the blessing of the SEC? How do you propose to integrate crypto into restaurant reservations or event ticketing without uptake by large organizations which will help spearhead changes and legitimize the technology? To be frankーit seems like our chances of any sort of institutional friendliness toward crypto evaporated overnight alongside FTX users’ deposits.

Counterpoint: “This proves why decentralized finance is necessary”

I don’t mean to be rude, but this is just obviously a cope. In some sense it is true, of courseーif you can simply inspect a protocol’s solvency onchain then bank runs need not happen. But why don’t we take this one step further and ask, why isn’t DeFi more popular right now?

- The vast majority of humanity clearly does not give a shit about decentralization

- Despite years of effort, crypto UI/UX remains a complete clusterfuck, and the normal man or woman is not going to use Aave or Compound just like how they are not going to “simply” install Gento and “simply” compile whatever software they need to use

- A new decentralized protocol is hacked or otherwise exploited on a seemingly weekly basis

- Outside of privacy mixers, gambling, and stablecoin usage for people in failed states, the actual market demand for decentralized finance is empirically clearly very low

If you shifted humanity’s IQ distribution up by two entire standard deviations and rebuilt the entire EVM interaction UX from scratch, then sure, perhaps in this utopian world of pure fantasy, people would be able to make great use of decentralized finance! But in the actual world of sad reality that we live in, if you exclude stablecoin payments in the undeveloped world, the only people who seem to actually be capable of making use of DeFi are highly educated engineers in the top 5% of the population, and even then a good number of them end up getting rugged by bridge hacks or “highly profitable trading strategies.”

I would also add that one might say with equal validity that the insolvency of FTX “proves why strict regulation is necessary” to protect American consumers from Ponzi schemes. Here’s a list of bank runs in the last 12 years from Wikipedia:

Wow! Looks like American regulations are actually doing a pretty good job of protecting us from bank runs! Maybe we should expand the American regulatory state to the rest of the world?

Counterpoint: “We will simply RETVRN to ~lunarpunk~“

Okay. I get it. You’re an ordinary citizen who hates the suits (who doesn’t?) and pines for the good ‘ol days of anonymous peer-to-peer transactions in parking lots and drug markets on Tor. Let’s just wash away all of this venture capitalist bullshit and start over. We don’t need the institutions!

Sure.

I hope you’re also okay with the following:

- The price of ETH never goes above $100 again, ever

- The vast majority of your friends in crypto (if you have any) eventually quit the space in disgust if they aren’t forcibly laid off

- Any visible onramp or offramp transaction is automatically assumed to have criminal intent and your bank accounts are immediately closed

- Only the 0.1% most technically competent and paranoid people in the world ever use crypto again

- The only use cases for crypto are drugs, tax evasion, bypassing state-level capital controls, prediction markets, and assassination

Look, I get itーI like peer-to-peer money! I think being able to buy drugs online is based!

But you should probably be careful about what you wish for.

Conclusion

LookーI have no real idea what’s going to happen. But there is a sense of shock in crypto. It is palpable. People are still completely at a loss! Every single person has absolutely no idea how to react, even people who have been here through multiple cycles!

If you are going to pretend that everything is A-OK and that crypto will definitely come back for another cycle, you better have a damn good reason why ’cause it’s not looking great!

November 11th, 2022 at 3:16 am

I read your thoughts carefully, and I am amazed at how pessimistic the environment you are in. To a certain extent, I agree with the theory of Hong Kong succession mentioned earlier by Arthur Hayes. While there is uncertainty about his future policies, enthusiasm for Hong Kong and the Chinese nationals behind him to get involved remains high.

November 11th, 2022 at 3:51 pm

I am teetering on the brink of making that splash into bitcoin. In fact, 3 days ago, when the price was $20,000, I was unable to find an acceptable counterparty on a P2P platform so I did not trade.

By the end of the day the price had dropped to the low 19000s, the day after it went into the 15,000s, so I thanked my lucky stars it did not work out.

Nevertheless, I am still looking for a good opportunity. I am not sure what to think about future trends, and it may well be south, but you have not provided any real, hard evidence as to why to think it is going to be over and out soon.

You have mostly provided gut feelings, and that for me isn’t good enough, whether they be north or south.

November 11th, 2022 at 4:12 pm

lmfao

November 12th, 2022 at 9:22 am

that’s a real doomer take if I’d ever seen one, so let me give a glass half full case

Most of our generation i.e. late-millennial to the current zoomers grew up with private internet money (runescape gold, mmo currencies etc.), whereas crypto is basically public internet money, an extension of that. I have never seen this talked about anywhere if ever. From this, with the simple observation that zoomers and those after them won’t just suddenly stop using the internet and the various internet monies, it just makes sense that “public internet money” will eventually supersede localized, fragmented “private internet money”.

I agree with you that decentralization does not and will not ever matter, simply because people just don’t care enough, similar to how people don’t care enough to look into who they’re voting for before actually doing so.

Which brings me to my glass-half-full hopium. Facebook brought the internet mainstream, to a point that people are using the internet on FB but without actually using the internet, in the sense of everything else the internet provides access to; crypto can do the same, as the rails underlying that a broader internet economy runs on or completely something else. The point being that they won’t *need* to understand how Aave, Compound works, nor how xy=k on Uniswap works, like how the average FB user doesn’t know how the stuff beneath the app works either.

All that being said, the upside to being in crypto right now, after all that’s happened this cycle is simply asymmetrical.

November 15th, 2022 at 10:30 pm

Sadly, I agree with some of your points and I’m surprised at btc’s current strength. What value does btc bring?

November 16th, 2022 at 12:46 am

“Sentiment is everything in crypto.”

Sentiment is everything in all markets. Crypto just has a smaller number of participants and less diverse range of opinions. So sentiment shifts faster.

Sorry the vast majority of your points apply to “crypto” in the worst sense of the word. They, by and large, do not apply to Bitcoin and the other project with merit. (All ~5 of them).

You think the people at the MIT Digital Currency Lab and other places like it coming up with the Bolt protocol and similar give a crap or have been dissuaded. No. Now that, what they think of as, the worst of the worst in the industry will stop getting so much dumb fuck money, possibly even the opposite.

November 17th, 2022 at 12:52 am

“Africans or Ecuadoreans or Venezuelans or people from literal failed states will always find some value in having access to crypto.”

It seems to me, even in failed states, absent bull market speculation, there is no reason to hold or transact in BTC instead of some stable coin, say USDC or whatever.

November 17th, 2022 at 7:15 am

Excellent points all around. It is different this time. Let’s hope that this is the final nail in the coffin for crypto; I can’t wait till I never have to hear another word about it again.

November 17th, 2022 at 1:06 pm

A well written post and thought experiment. I had some similar feelings when this first blew up, and the comparison of DeFI to FREEEEEEEEE SOFTWARE is good and valid.

That said, one counterpoint can be made against the argument that authority will now be motivated to crush crypto.

The counterpoint is the fact that I am on this blog in the first place. Likely due to SBF’s elite, liberal, Jewish networking, TBTB appear to being doing their best to sweep this entire fiasco under the rug. The New York Times, Wall Street Journal, and Bloomberg appear to be doing as little due diligence as they can get away with.

So while the lawsuits will drag on for years, the Eye of Sauron might just move on in a few weeks.

November 17th, 2022 at 2:26 pm

[…] Milky Eggs here makes the doomer case that this is the beginning of the end. Not that crypto will entirely disappear, store of value still has some worth especially in failed states, but that there will not be a comeback this time. Similarly, Noah Smith asks, what if crypto just dies? […]

November 17th, 2022 at 2:38 pm

Counterpoint: If crypto and blockchains represent an important and interesting technological advance, then whether current smart stakeholders get burnt or not does not really matter much other than in the very short term. If there are apples in the garden, they will be plucked whether or not there are snakes abound (mix the metaphors a bit).

I’d point to the dot com bust and that era more generally, where many smart stakeholders (in addition to less smart ones) were burnt; but the underlying technology was promising.

I do agree with you however that the short term headwinds are non-trivial; but coming as it does in the middle of a macro-economic storm, I am not sure it’ll make that much more of a difference from a multiplicative standpoint.

November 17th, 2022 at 6:33 pm

So how does this reconcile with your 6 ong term trends in crypto predictions you made less than 12 months ago?

November 26th, 2022 at 3:04 pm

The bank run list you are relying on is grossly incomplete.

There are 560+ failed US banks since 2000.

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

March 7th, 2023 at 4:18 am

Reading this post in mid-Nov had a significant effect on me choosing to resign from one of the largest crypto VCs. Very compelling and well written.